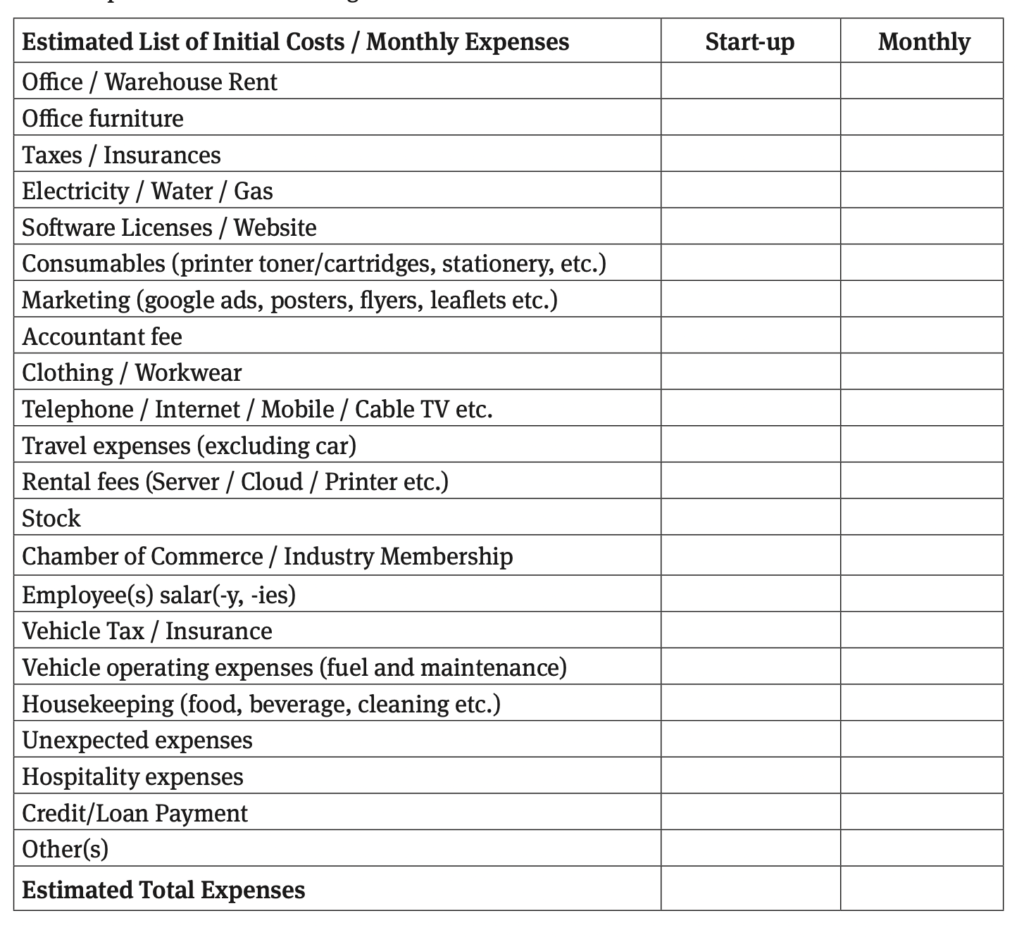

Social enterprises need establishment and working capital just like other businesses. During the establishment phase, there will be expenses in 3 main areas as listed below:

Determining the start-up / setup costs of the business

Determination of monthly running expenses

Entrepreneur’s survival budget

In general, for many businesses it is difficult to make a lot of money in the first year. Thus, a detailed list of initial and monthly expenses table is provided above to allow people planning to setup a social enterprise can calculate what they need to survive in the first year. You need to calculate the initial costs as well as monthly expenses. An entrepreneur should figure out each of these costs and find necessary funds for them. Remember that you have to provide necessary funds for your business until your business generates income and covers costs. If you do not have your own money to fund your business then you will need to use one or more of the resources presented in Section 6.2.

If you are quitting your job for your startup then you have to include all of the items that you have the responsibility to pay for in your household (e.g., childcare, credit card payments, hobbies, entertainment, mortgage etc). Thus, if these items are missing on the above table, then add all of them to the ‘Other(s)’ line.

After you complete the table with the estimated figures you will know how much initial investment will be necessary for your enterprise. This funding should cover establishment expenses as well as running costs until your enterprise generate revenues.

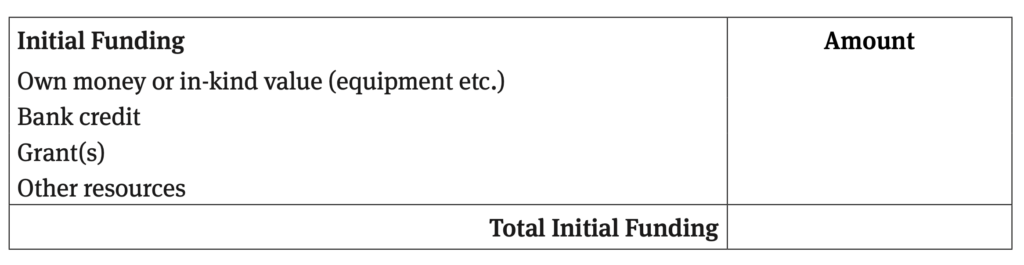

You need to move to below table to list your estimated potential resources to see that whether your initial funding covers your initial estimated expenses. If the initial funding is not fully covering the expenses, then you need to find additional funding to cover that part.

Up to this point we have just figured out how much money you need initially to startup and run your business. These are the outgoing funds and we should move to calculate your enterprises’ turnover in the first operating year to see whether it generates much more income than outgoing expenses.